Add a case of counterfeiting to the incident of money laundering tied to the landlord in line to receive an inexplicably favorable lease rate for a portion of a warehouse the City of Los Angeles plans to convert into a homeless shelter.

Questions about the background of Moiz Kaboud cropped up in last week’s column, with a report on his ties to a money-laundering case that stretched back to the late 1990s.

More questions arrived this week when a source sent along documents related to a 2008 judgment by a federal court that found a company called A.F.M.K. Inc. had infringed on trademarks of Milan-based fashion label Gianni Versace S.p.A.

More questions arrived this week when a source sent along documents related to a 2008 judgment by a federal court that found a company called A.F.M.K. Inc. had infringed on trademarks of Milan-based fashion label Gianni Versace S.p.A.

A.F.M.K is based at 1426 Paloma St. on Downtown’s industrial edge – the building where the city plans to lease space for the homeless shelter.

State documents indicate Kaboud was president of A.F.M.K. at the time of the counterfeiting case and remains in the role. State documents also indicate he is chief executive of B.F.P.Z. LLC, the entity identified as the landlord of the building in the city’s lease agreement for about 17,900 square feet of space on Paloma Street.

That’s about half the space called for in an earlier agreement.

SullivanSaysSoCal on April 30 reported that the city had redone the deal on Paloma Street, making the cut to the space it would get for the homeless shelter while maintaining the full, $35,000-a-month lease payment – effectively doubling the rate the city will pay per square foot.

Both Mayor Eric Garcetti and City Councilmember Jose Huizar, who initially proposed the deal, have refused to comment on why the city would agree to pay the same amount of rent for half the space at the Paloma Street property.

The two elected officials also declined to comment on Kaboud’s past ties to money laundering and counterfeiting.

Kaboud paid more than $500,000 to settle the case of money laundering. He apparently used unreported income to acquire a liquor store in LA and make other investments.

The case of counterfeiting put Kaboud at odds with legitimate operators in two key industries in LA: entertainment and fashion.

Trademark infringement and counterfeiting of intellectual property such as fashion brands, movies and music have long been a bane to legitimate apparel designers and the makers and stars of film and music. Cases of counterfeiting in the garment industry often amount to a person or company using an asset they have no right to use, such as a brand or logo, for illicit commercial gain. Another way to say it: stealing someone else’s trademarked creative work and using it to peddle clothes under false pretenses.

Apparel designers and legitimate manufacturers who have built valuable brands are often hurt by counterfeiters in two key ways: they lose immediate sales to the counterfeit pretenders who offer fake brands at cheap prices; and the reputations of their brands often sustain damage because counterfeiters typically turn out merchandise of lower quality than the genuine brands.

The case against A.F.M.K. included a 2008 finding by the U.S. District Court that the company violated the federal Lanham Act on trademark infringement and counterfeiting. Filings indicate that A.F.M.K. struck a private settlement agreement with Versace.

The case also shed light on another curious aspect of the Paloma Street deal. Various reports from Huizar’s office and several media outlets have identified a Michael Kaboud as the owner of the property.

None of the various state and city documents on Kaboud’s businesses or the lease deal on Paloma Street list a Michael Kaboud.

The federal court’s judgement in the counterfeiting case is the first document obtained by SullivanSaysSoCal that provides confirmation that Moiz Kaboud sometimes uses Michael as a first name. The document also states that he sometimes spells his last name Kabud.

Columnist’s View

Allow me to note that the case of the Paloma Street homeless shelter is just one of many matters involving LA City Hall that carry the stink of corruption.

A couple of obvious sources of odor: Kaboud’s involvement in money laundering indicates he knows how to hide sources of income and cash itself. His involvement in the counterfeiting case indicates that some of his income came on illicit business that benefited by damaging legitimate operators.

Another source of stench: The presence of IRS agents alongside the FBI investigators who raided Huizar’s offices and house indicates that unreported income is likely part of the ongoing probe of City Hall, where word has circulated that Huizar had false walls in a closet to keep cash.

The FBI and IRS are asking questions of their own – and indicators point to the probe going well beyond Huizar, with trails leading to other members of the City Council and the mayor’s office.

SullivanSaysSoCal is proceeding along several lines of journalistic investigation. Some might overlap with the federal investigation while others might not.

Readers will be kept posted in any case.

Santa Clarita Valley’s 206-Acre Call

Cheer up – there is some opportunity and ongoing strength to tell you about, although neither is anywhere near LA City Hall.

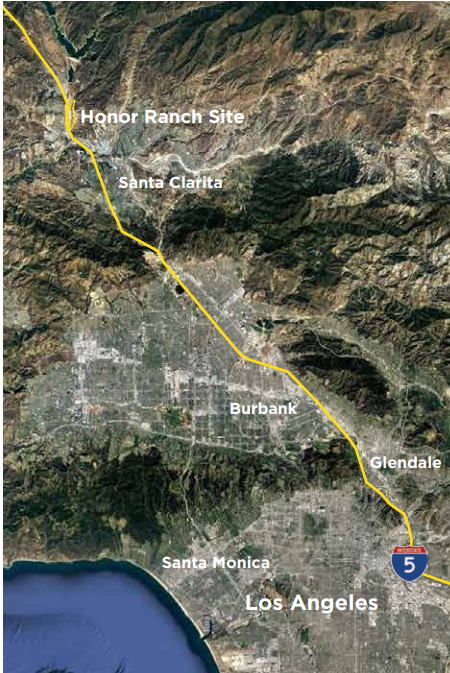

Let’s start with an opportunity in the Santa Clarita Valley, where Los Angeles County has put out a request for proposals on the development of a 206-acre chunk of the Honor Ranch parcel in Castaic.

The site is about 40 miles north of Downtown LA, with two miles of land fronting the 5 Freeway. It features “flat topography conducive to development” in an area bounded by the Castaic Creek Wash and Pitchess Detention Center on the east; a neighborhood mostly filled with single-family homes on the west; Tapia Canyon Road and the Castaic Sports Complex to the north; and Castaic Junction and Biscailuz Drive to the south.

The site is about 40 miles north of Downtown LA, with two miles of land fronting the 5 Freeway. It features “flat topography conducive to development” in an area bounded by the Castaic Creek Wash and Pitchess Detention Center on the east; a neighborhood mostly filled with single-family homes on the west; Tapia Canyon Road and the Castaic Sports Complex to the north; and Castaic Junction and Biscailuz Drive to the south.

County officials indicate they’re keen to draw employers to the site, which offers a chance for them to capitalize on a new mixed-use community taking shape under Irvine-based FivePoint Holdings LLC – a plan that includes significant commercial development to go with residential offerings in nearby Valencia.

FivePoint’s plans appear to be a big part of the county’s pitch for the Honor Ranch land. The RFP says the site stands to benefit from a “30% projected population growth through 2040, and up to 32,000 residential units planned or proposed in the area.”

Proposals are due by July 3, according to the document, and “the County is targeting a development that provides high-quality jobs.”

Sunny Outlook for SA Office Complex

A recent move to put an office complex for sale at more than twice the price it fetched four years ago sheds lights on the ongoing health of OC’s real estate market; the area’s vibrant economy overall; and a sweet spot amid Santa Ana, an oft-overlooked gem.

The 391,000 square foot Pacific Center, which includes buildings at 1600 and 1610 E. Saint Andrews Place, carries an asking price of $100 million.

An entity under the umbrella of Santa Monica-based Pacific Coast Capital Partners paid $43.9 million for the two-building center in 2015.

The current owners put about $3.5 million worth of renovations into the place. The upgrades came to the lobbies, landscaping and a 2,100-space parking lot that serves both buildings, which retain the spread-out, low-slung feel of a suburban office park.

Watch for the final sales price on this one. If Pacific Coast Capital Partners gets its $100 million – or even close to it – the lion’s share of the gain will likely owe to a generally strong market and attractive location that often goes overlooked among OC’s growing landscape of office centers, many of which have taken on an increasingly metropolitan character in the years since the Great Recession.

Hebrew U Speaks to All

This column recently presented a good example of how the intellectual inquiry and critical thinking that are rooted in the Jewish faith and part and parcel of Jewish culture brought about a special moment at a recent talk by the author of a book that viewed the Holocaust in the context of a small town.

You can check the archives for the video in the May 7 edition at SullivanSaysSoCal.com for a refresher.

This week offers another reminder of how those Jewish traditions add to our American tapestry.

This one is from Bret Stephens, a veteran of the Wall Street Journal, one-time editor of the Jerusalem Post, winner of a Pulitzer Prize, and current columnist for the New York Times.

It comes courtesy of the eloquent and unvarnished keynote address he delivered to the crowd at the annual fundraiser put on by the American Friends of the Hebrew University’s Western Region chapter, held on May 16 at the Beverly Wilshire.

It comes courtesy of the eloquent and unvarnished keynote address he delivered to the crowd at the annual fundraiser put on by the American Friends of the Hebrew University’s Western Region chapter, held on May 16 at the Beverly Wilshire.

The annual event also saw Brian Panish of Panish, Shea & Boyle LLP receive the annual Harvey L. Silbert Torch of Learning Award and give a heartwarming and funny acceptance speech that managed to give Southwestern Law School the biggest plug it’s likely to ever get.

Patty Glaser of Glaser Weil Fink Howard Avchen & Shapiro LLP – a sponsor of this column – served as general dinner chair. She injected another humorous note into the evening when she told the crowd that anyone who wants to catch up on world affairs “can read about 20 books” or spend some time with Stephens.

Patty Glaser of Glaser Weil Fink Howard Avchen & Shapiro LLP – a sponsor of this column – served as general dinner chair. She injected another humorous note into the evening when she told the crowd that anyone who wants to catch up on world affairs “can read about 20 books” or spend some time with Stephens.

Yes, Glaser was kidding – but there was some truth to her crack, as you’ll see by clicking here for a key excerpt of Stephens’ message:

More Than MOCA in Giving Spree

The Museum of Contemporary Art Los Angeles and board member Carolyn Powers might have gotten the headlines for her $10 million donation to subsidize free admission, but that wasn’t the only eight-figure gift made in LA last week.

The American Friends of the Hebrew University announced a $10 million gift to the school from an anonymous donor – an outsized cherry on top of the nearly $1 million raised by the gala fundraiser.

And works donated by 40 artists raised $12.4 million for the UCLA-affiliated Hammer Museum in Westwood Village, which became free to the public five years ago with the backing of benefactors Erika J. Glazer and Brenda R. Potter.

The money raised in the Artists for the Hammer Museum sales series came at Sotheby’s New York over the course of May 16 and May 17. The LA office of the auction house joined the Hammer to host a preview of the stuff during a reception at the UTA Artist Space in Beverly Hills on April 18, as reported in SullivanSaysSoCal’s edition of April 23.

The total zoomed beyond a pre-sale high-water estimate of $8.1 million, helped along by Mark Bradford’s Scratch Pink, which brought a price of $3 million. The entire lot of 40 art works found buyers, and new records were set with pieces donated by Charles Gaines, Rashid Johnson, Jimmie Durham, Shio Kusaka and Kevin Beasley.

Proceed will go to support the creation of an Artist Fund, which will “support the museum’s pioneering exhibition program and its work with emerging artists,” according to the Hammer, as part of a larger $180 million plan for a renovation of the museum and expansion of its endowment.

Don’t Forget to Enjoy the Fish

Plenty to like about the Aquarium of the Pacific’s new Pacific Visions wing in Long Beach, where visitors will be treated to what are billed as a “state-of-the-art immersive theater, interactive art installations, engaging multi-media displays, and live animal exhibits” when it opens to the public on May 24.

The order of that list of features offered a clue of how much civic and institutional views of the environment in general and wildlife in particular have changed.

More clues came with remarks by Dr. Jerry Schubel and others during a May 16 preview. The speakers were chock full of mentions of how the new wing will help the Aquarium of the Pacific deliver lessons of environmental concern.

The drumbeat was steady enough that I nearly relegated the sneak peek of the facility to the day’s background.

There’s good reason for the environmental concerns, to be sure. But here’s a reminder of something else that matters: aquariums can be very beautiful and quite soothing – and it’s OK to enjoy both of those qualities and forget the burdens of the world for a moment.

Some Symbiosis for CFA Society Symposium

Note the LA-OC crossover on tap for the CFA Society Los Angeles’ inaugural Portfolio event slated for May 30 at the Omni Hotel on Bunker Hill.

A complement of LA money mavens will address the crowd, along with more than a few visitors from New York and other markets. That’s to be expected – CFA stands for Chartered Financial Analyst, after all, and it’s a hard-earned designation that’s highly valued in the marketplace.

So it should come as no surprise that a couple of speakers will call on the conference as neighbors, coming up from OC to deliver remarks.

Jane Buchan, previously a driving force of Irvine-based fund of hedge funds PAAMCO, will address the crowd from her new perch as cofounder and chief investment officer of Martlet Asset Management in Newport Beach.

Also on a panel during the day-long gathering will be Daniel Ismail of real estate research specialist Green Street Advisors in Newport Beach.

Oaktree Capital CEO Jay Wintrob, meanwhile, will get the event some exposure well beyond LA or OC, sitting for a “Fireside Chat” to be moderated by CNBC correspondent Jane Wells.

Put Wintrob down for the shortest commute to the event, by the way – the Omni is just across Grand Avenue from Oaktree’s HQ.

Sullivan Says

There’s no commercial stretch of the City of Angels with a more puzzling potential than La Brea Avenue between Pico Boulevard and 3rd Street.

Pingback: Email Points to Priorities Besides Homelessness for Prop HHH | OC Marks Mendez | Quick Math on AECOM | MVE Gets Plaque, Perspective - SullivanSaysSoCal